Medicare Advantage Plan: When you are looking into Medicare for either diabetic supplies or any other type of health issue that requires monthly prescriptions you must know some things about it. First, you should recognize that there are so many parts of Medicare plans to choose from and while Part A and Part B are covered under the Original Medicare Plan, many people are looking further into other plans such as Medicare Advantage.

Medicare Advantage is a plan that allows for private health insurance plans inside the Medicare program to be chosen instead of standard Medicare plans such as Plan A and Plan B. Members will receive their health care needs from a private plan while Medicare pays a certain amount of money monthly. It does not matter if the member actually uses health care services that month or not.

With Medicare Advantage members are supplied with lower co-payment costs as well as extra benefits. However, just like with members who are on the Original Plans A and B, members must use doctors and hospitals that are located on the plan roster.

You do not have to do anything special or pay extra or have any special concerns to be part of Medicare Advantage, you just have to sign up for that particular plan. If you are eligible for Medicare Parts A and B than you are eligible for Medicare Advantage, as long as the pre-member lives in a area that is available for Medicare Advantage. There are certain areas that do not have Medicare Advantage although the issue is currently being worked on to supply the plan to rural areas without it.

When it comes to the Medicare Advantage program, there are different ways that the program itself works. For instance, some private insurance plans will pay a certain amount of your Medicare A and B plans would. Others will pay the whole premium. Nearly all private insurance programs will cover drug prescriptions and many other benefits that are not covered on the Medicare Plan A and B.

Even if you chose Medicare Plan A or B in the beginning of choosing Medicare as your health provider, you can still switch Medicare Advantage as soon as you want to. Medicare Advantage is more helpful than other plans but can have unnecessary benefits if you are looking for something much simpler.

Check into the Medicare Advantage plan and remember that health care is always changing therefore the best thing that you can do is to keep yourself updated about Medicare changes and the best way to do that is by looking up updates online.

There are over 24 million Americans who have been diagnosed with diabetes and more than 25 percent of them will develop some sort of foot

There are over 24 million Americans who have been diagnosed with diabetes and more than 25 percent of them will develop some sort of foot  Through

Through

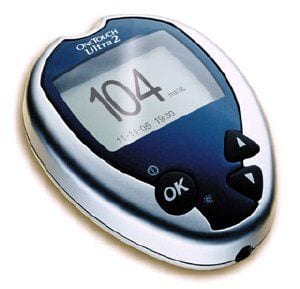

If information is power than knowing as much as you can about the

If information is power than knowing as much as you can about the